In today’s complex global trade environment, selecting the right general trading company can directly impact your business success. Whether you’re sourcing goods, entering new markets, or managing international supply chains, your trading partner must be reliable, compliant, and operationally competent.

But with thousands of firms in the market, how do you identify the right one?

Disclaimer: This article is for general informational purposes only. It does not constitute commercial, legal, or financial advice. Businesses should conduct independent due diligence and consult professionals before entering into commercial relationships.

Why Your Trading Partner Matters

A general trading company often acts as your local face in foreign markets. They may:

- Source products

- Handle import/export formalities

- Manage logistics

- Represent your brand to regulators or suppliers

The wrong partner can result in compliance violations, delayed shipments, quality issues, or even financial loss. That’s why due diligence and clear selection criteria are critical.

7 Factors to Consider When Choosing a Trading Partner

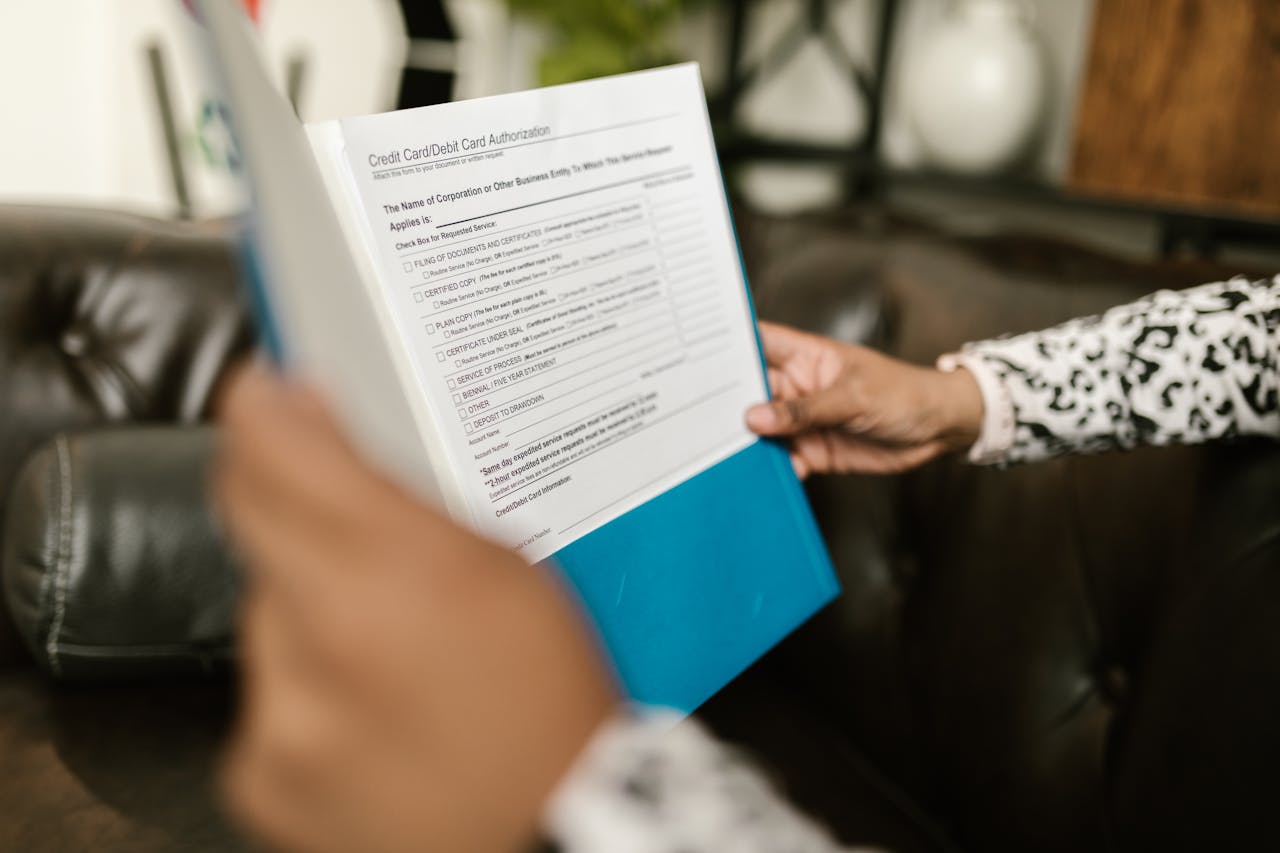

1. Licensing and Legal Structure

Ensure the company holds valid:

- Import/export licenses

- Trade or distribution permits

- Country-specific operational licenses (if required)

🛡️ Always verify legal registration, tax status, and authorization for international operations.

2. Operational Experience and Track Record

Look for companies with:

- Proven experience in your industry or region

- Case studies or client references

- Multi-year operational history

Avoid newly formed entities without demonstrable trading volume or compliance history.

3. Product Scope and Market Specialization

Some trading companies focus on a specific sector (e.g., FMCG, electronics), while others are broad-spectrum. Choose based on your needs:

- Do they know your product category?

- Are they familiar with its logistical and regulatory nuances?

- Can they advise on packaging, labeling, or localization?

4. Transparency and Communication

Good trading partners provide:

- Transparent pricing models

- Clear fee structures

- Regular reporting and shipment updates

Avoid firms that are vague about costs, timelines, or supplier arrangements.

5. Compliance and Risk Controls

Ensure the company demonstrates:

- Knowledge of Incoterms and international trade rules

- Familiarity with customs regulations and sanctions

- Documented risk management processes

Ask if they conduct due diligence on suppliers, use quality control procedures, or work with insured freight forwarders.

6. Financial Standing and Payment Flexibility

A strong trading company should be:

- Financially stable

- Capable of offering structured payment terms

- Open to escrow, letters of credit, or milestone payments

This ensures both parties can manage risk and protect capital.

7. Technology, Infrastructure, and Systems

Modern trading companies often use:

- Digital order management systems

- Customs clearance platforms

- ERP or inventory control tools

- Multichannel communication (email, messengers, dashboards)

This improves coordination and transparency for international clients.

Red Flags to Avoid

❌ No website or unclear company details

❌ Avoids sharing client references

❌ Pushes for upfront payments without formal contracts

❌ Poor communication or delayed responses

❌ Promises unusually low prices or too-fast delivery

How to Conduct Basic Due Diligence

- Company Verification: Check registration records, tax ID, and licenses

- Online Footprint: Review their website, LinkedIn, or industry directories

- Third-Party Checks: Use local chambers of commerce, embassies, or professional services

- Contractual Protections: Always use written contracts with defined responsibilities, liabilities, and payment terms

Conclusion

Choosing the right general trading company is more than a procurement decision — it’s a strategic partnership. A qualified and professional trading firm helps you:

- Navigate unfamiliar markets

- Reduce risk and compliance exposure

- Accelerate operations and deliveries

- Focus on your core business while they handle the rest

Need a Reliable General Trading Partner?

We work with businesses across multiple industries to support safe, efficient, and scalable international trade.

Get in touch to learn how we can help you move forward with confidence.